This article is part of a blog post series, Policy Actions for Racial Equity (PARE), which explores how housing policies contribute to racial disparities in our country.

The COVID-19 pandemic caused significant economic upheaval, hitting housing affordability and stability especially hard. To help limit the economic fallout, the federal government stepped in, strengthening pre-existing assistance programs such as unemployment benefits and child tax credits, while also implementing new measures including eviction and foreclosure moratoriums and stimulus payments. These programs provided a much-needed buffer to help limit economic turmoil, especially for BIPOC (Black, Indigenous, and other people of color) households, who were most vulnerable to these destabilizing effects.

Yet a recent Enterprise analysis found that while foreclosure risk overall declined from September 2020 to November 2022, gaps remained between white homeowners and homeowners of color who reported being behind on their mortgage payments and likely to lose their homes. That persistent gap indicates government interventions during the pandemic did little to shrink systemic inequities in housing stability for households of color, who continue to face foreclosure risks at more than twice the rate of white homeowners.

Our analysis used the Census Bureau’s Household Pulse Survey, which monitors the effects of the pandemic on health, employment, education, food security, and housing conditions on a representative sample of American adults. Conducted in a series of phases across the pandemic, the Pulse Survey provides a detailed, timely, and comprehensive means for assessing how foreclosure risk varied between BIPOC and white homeowners over the course of the pandemic. For this analysis, we grouped survey responses by phase, starting with Phase 2 (conducted September-October 2020).

Missed Payments as a Precursor to Foreclosure

The road to a foreclosure begins with a homeowner not being able to make their mortgage payment. According to the Pulse Survey, the share of all owners with mortgages who reported being behind on their payments hovered around 10% between September 2020 and March 2021. That share decreased to about 7-8% after March 2021 through early 2022, as the cumulative effects of economic stimulus measures, coupled with vaccine rollouts and a lifting of other pandemic-related protections, helped ease the economic burden faced by many homeowners. From early 2022 to the end of the year, we saw the rate further decrease to approximately 6%, likely reflecting a return to more normal economic conditions.

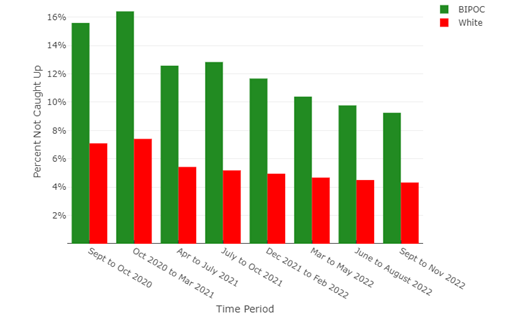

However, this decrease did not occur evenly between BIPOC and white households. When disaggregated by race and ethnicity, we see 2-3 times higher shares of BIPOC mortgage holders behind on their payments relative to white homeowners across the study period (see Figure 1). Even as this share declined more for BIPOC owners over time – from over 15% in late 2020-early 2021 to under 10% by mid/late 2022 – the gap between the two groups remained stubbornly large.

Figure 1: Share of Homeowners with Mortgages Reporting Not Caught Up with Payments

These gaps remained despite the extraordinary efforts taken to assist homeowners during the pandemic, including foreclosure moratoriums and mortgage deferral options offered by some lenders. This suggests larger structural and systemic inequities in mortgage affordability and payment processes that make BIPOC homeowners more susceptible to falling behind on their monthly payments, which will require further interventions to amend.

Likelihood of Foreclosure After Missing Mortgage Payments

Falling behind on mortgage payments is not a guarantee of being removed from a home, as many owners are able to catch up or “cure” their default before their lender initiates a foreclosure. However, each household unable to make a mortgage payment still faces this risk, and their perceptions of whether they will lose their home will vary based on their personal circumstances.

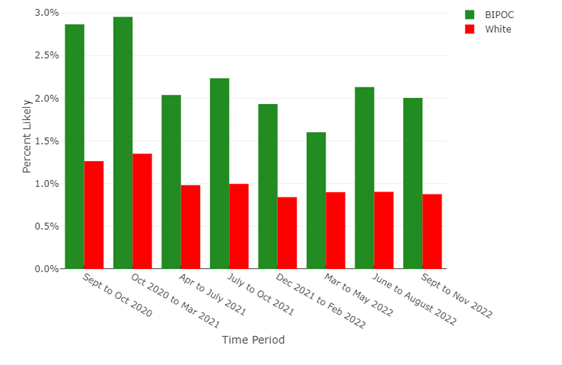

According to the survey, BIPOC owners expressed a much higher likelihood of a foreclosure relative to white homeowners (see Figure 2). This is mostly due to the former’s higher share of owners behind on their mortgage payments, as the survey only asked owners who missed a payment about their foreclosure risk. Both groups also experienced only slight declines in their perceived foreclosure risk over time.

Figure 2: Share of Homeowners with Mortgages Reporting Very/Somewhat Likely to Experience a Foreclosure

These findings suggest that, while interventions to support homeowners struggling with housing payments were effective early in the pandemic, perceptions about the risk of foreclosure did not experience the same decline over time, as the share of homeowners behind on their payments who report a high likelihood of foreclosure remained fairly steady.

Implications for the Future

The analysis demonstrates both the challenge and necessity of applying a racial equity lens to policy interventions that seek to support homeowners through periods of financial strain. Even though the unprecedented measures taken by policymakers helped improve housing stability during the pandemic, they did not rectify the systemic disparities faced by BIPOC homeowners, who consistently reported higher rates of falling behind on their mortgage payments and perceived risk of foreclosure. Eliminating these disparities requires a focus not just on their consequences but on their source – namely, inequities in income, wealth, access to credit and affordable homeownership opportunities.

Fortunately, governments at all levels have the ability to address these root causes of foreclosure risks, as well as mitigate their impacts on BIPOC homeowners. Actions like adding more supports for owners struggling to keep up with their mortgage payments, requiring lenders to offer flexible terms and forbearance programs similar to those provided during the pandemic, and increased oversight of home appraisal processes that undervalue homes in BIPOC neighborhoods can all help homeowners retain and grow their housing wealth for the long term.

We encourage all who believe in creating a just society to read, discuss and share the PARE blog series as we learn and act to address the impacts of housing policies on racial equity in America. We also invite you to join us in this conversation by suggesting additional topics and sharing resources for how we can advocate for greater racial equity. If you would like to offer feedback on our body of work, please reach out to the Public Policy team. You can also check out our blog and subscribe to our daily and bi-weekly policy newsletters for more information on Enterprise’s federal, state and local policy advocacy and racial equity work.

This work was supported by the JPMorgan Chase & Co. The funders had no involvement in the conduct of this research or in the preparation of this article.