Track Record

| Investment Experience | Social Impact |

|

|

Our Portfolio

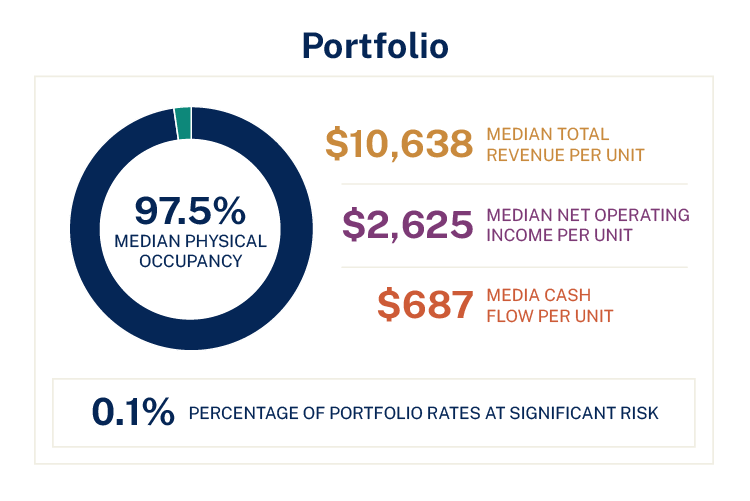

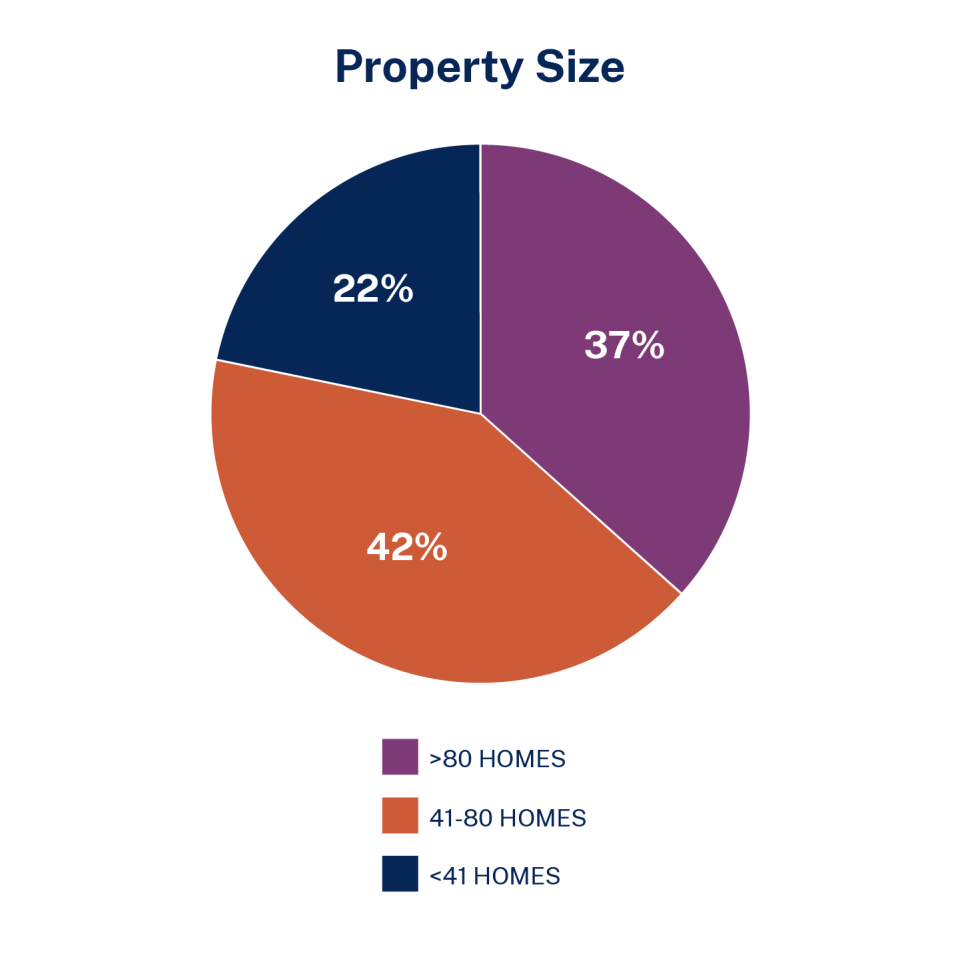

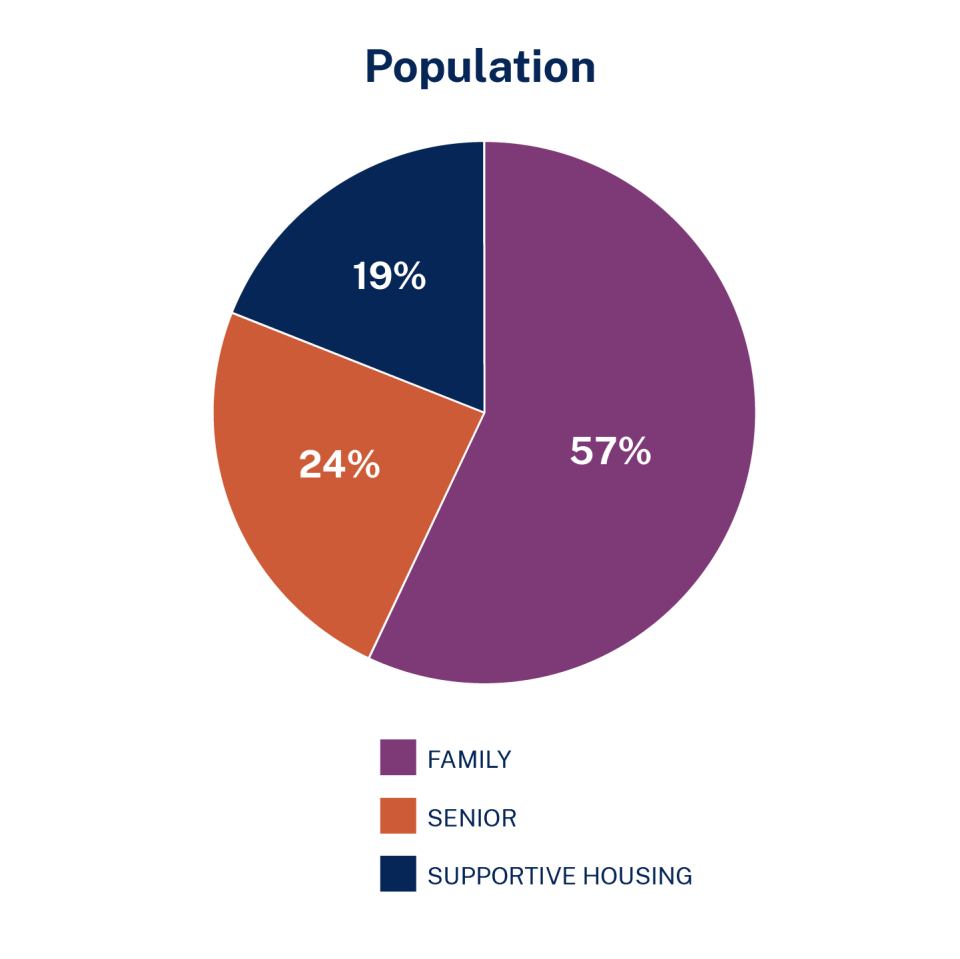

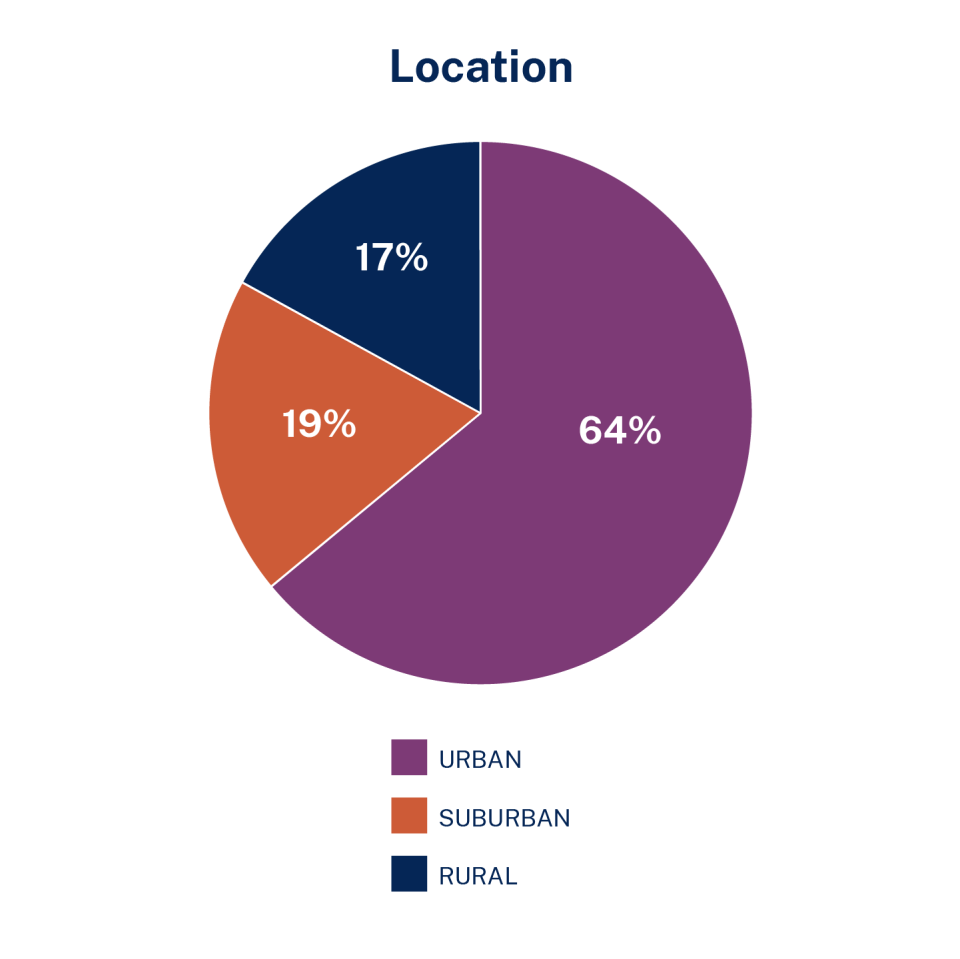

We manage over 1,300 properties in our current portfolio (net of dispositions). That represents 201,000 homes and $15.7 billion in invested equity.

Our annual Trends Analysis report gives the latest stats on our portfolio and strength.

|

Image

|

Image

|

Image

|

How We Partner with You

We’re an active listener and a proactive partner. First, we get to know you and your goals so we can recommend the best financial structure for your deal. Then, with a staff committed to providing best-of-class service, we support you over the duration of the transaction.

- We meet your goals with a range of single- and multi-investor low income housing tax credit funds.

- Enterprise doesn’t end with tax credits. With our broader suite of equity and debt products, we can meet any additional capital needs you have.

- After closing, we provide fully-integrated asset management services to optimize both your investment and its impact long-term.

Our Housing Credit Investments team is committed to making home a place of pride, power and belonging. That's why we reinvest every dollar of net income back into the industry.

Asset Management

We're here for the entire lifecycle of your investment. Our fully-integrated Asset Management team handles everything from compliance obligations to construction-monitoring, to reviewing your capital account for tax issues. Above all, we ensure that your investment is optimized and sustainable for the long-term.

- We’re experienced working through the most challenging situations.

- We detect potential issues quickly and partner with you to problem-solve.

- At disposition, we help ensure the development’s long-term affordability and sustainability.