Track Record

| Investment Discipline | Social Impact |

|

|

Since the NMTC was enacted, we’ve partnered with banks, developers and community organizations across 24 states and Washington, D.C., to create or rehabilitate nearly 106 projects.

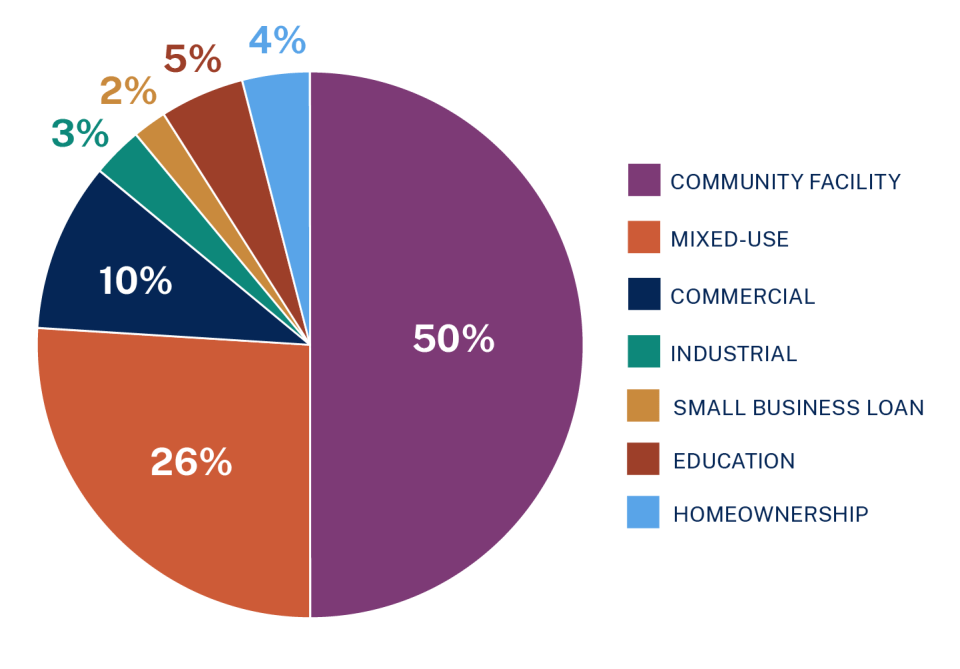

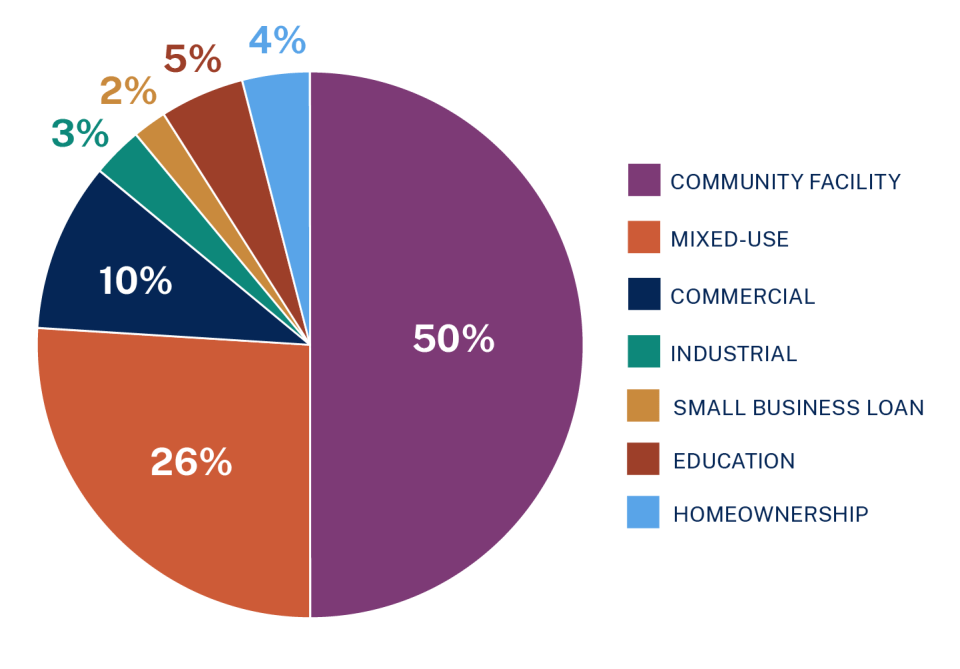

Current Portfolio

Focus Areas

- Jobs: Create employment opportunities for people across education and experience levels

- Health Care: Bring health and wellbeing resources (physical and mental health services, healthy food access) to underserved communities

- Community Facilities: Finance spaces for nonprofits to provide social service programming for vulnerable neighborhood residents

- Racial Equity: Partner with Black, Indigenous, and people of color (BIPOC)-led organizations and housing providers who have been historically marginalized

How We Work

Whether it’s affordable industrial space for makers and artisans in New York City, a shelter for women and children experiencing homelessness in Miami, or a hub for the blind and visually impaired in San Francisco, we make possible deep and lasting impact. When you partner with us, you help create jobs, educational opportunities, health and wellbeing resources, and new opportunities for communities that need it.

Developers & Project Sponsors

We work locally and nationally with mission-driven developers, sponsors, and other Community Development Entities (CDE) to build transformative projects in communities across the country. A small sample of the work we’ve accomplished with our partners includes:

- Workspace for small-scale manufacturers in Brooklyn, New York

- YMCA and aquatic center in Yakima, Washington

- Substance abuse treatment facility in New Orleans, Louisiana

How We Partner with You

Together, we fill community resource gaps, address neighborhood needs and bring new opportunities to the residents to communities that need it – by increasing the supply of affordable homes or building (or rehabbing) high-impact community facilities. And, through Enterprise’s full range of debt, equity and tax credit financing products, we’re able to meet all of your capital needs from one, integrated platform, as well as compliance requirements, including:

- Training and compliance

- Maintaining required records

- Testing and monitoring allocation agreement and IRS regulatory compliance

- CDFI Fund compliance reporting

- Investor and board reporting

- Unwinding NMTC transactions at the end of the compliance period

Investors

We partner long-term with investors to build and rehab life-changing projects in communities that need it across the country. A small sample of the work we’ve accomplished with our partners includes:

- Ronald McDonald House in Baltimore, Maryland

- Community tribal medical clinic in El Paso, Texas

- Mixed-use campus of affordable homes, job training center for disadvantaged veterans, and nonprofit space in Everett, Washington

How We Partner with You

We help investors secure reliable tax credit benefits while their investment helps to develop or rehab high-impact projects like good homes with affordable rents, schools, healthy food options, manufacturing centers and new businesses and shops, among others.

Fund Management

We provide investment fund management services to investors, including:

- Accounting

- Loan servicing

- Reporting

- Monitoring the CDE's NMTC and transaction document compliance

- Unwinding NMTC transactions at the end of the compliance period