Creating affordable housing often involves solving a complex financial puzzle and navigating multiple funding sources to make a development pencil out. Yet as many housing leaders have learned, certifying to Enterprise Green Communities can provide access to capital and contribute to making developments financially viable.

The Green Communities Criteria is a standard for the design, construction, and operation of healthy, energy-efficient, and climate-resilient affordable homes. Originally launched in 2004, the program emerged to translate the collective expertise of leading housing and green building practitioners into a clear, cost-effective framework for all affordable housing development types, including: new construction, substantial rehab, moderate rehab, adaptive reuse, and historic renovation in both multifamily and single-family developments.

In addition to supporting the development of healthier, more efficient and resilient homes for residents, here are four ways Green Communities certification can bolster your bottom line.

1. Increase Low-Income Housing Tax Credit Application Scores

Thirty-two states and several major cities, including New York and Washington, D.C., incentivize or require Green Communities certification in their Low-Income Housing Tax Credit (LIHTC) programs, providing a pathway to boost an application’s score and the likelihood of receiving an award. The criteria also provide a framework to meet other requirements and incentives called out in these state programs. Additionally, some Community Development Block Grant Disaster Recovery (CDBG-DR) funding programs, such as Louisiana’s, mandate green building certification to access the funds.

2. Qualify for the 45L Energy Efficiency Home Credit

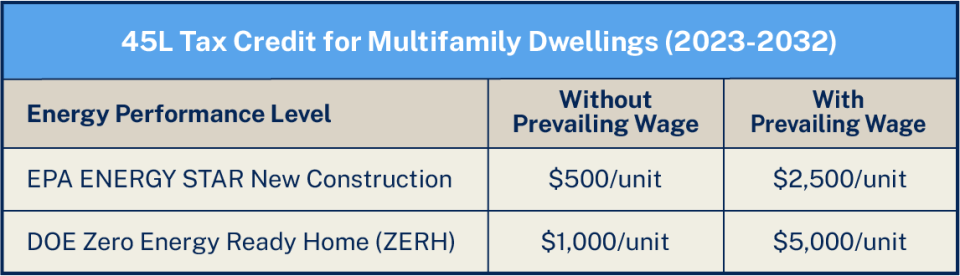

The Inflation Reduction Act (IRA) extended the 45L Energy Efficiency Home Credit for a decade. A pivotal change is the elimination of the LIHTC-eligible basis reduction, allowing individuals to claim the credit without reducing their LIHTC eligible basis. To qualify, you must obtain ENERGY STAR certification (already a component of Green Communities certification for new construction) or adhere to the U.S. Department of Energy Zero Energy Ready Home (ZERH) standard, part of Green Communities Plus certification.

The process is straightforward – there’s no application; the credit is earned by the eligible contractor upon placement into service and can be allocated in that fiscal year (consult your tax professional for details). Eligible structures include new multifamily, manufactured, and single-family homes, as well as substantial rehabilitations, with varying credits based on energy performance and whether prevailing wage standards are met. As of Jan. 1, 2024, buildings five stories or higher can earn ZERH certification, enabling buildings of all heights to obtain the higher level of the credit.

45L Tax Credit for Multifamily Dwellings (2023-2032)

3. Tap into IRA Programs

The 2020 Enterprise Green Communities Criteria align with several IRA programs, including HUD’s Green and Resilient Retrofit Program (GRRP) (hear from awardees in our recent webinar), EPA’s Greenhouse Gas Reduction Fund (GGRF), and DOE’s Home Energy Rebates Programs, providing a pathway to qualify for funds and execute successful developments.

These programs offer additional resources and incentives to developers and investors committed to sustainable affordable housing. Applications are still being accepted for all three tracks of the GRRP, with deadlines between February and May 2024. Monies through the GGRF and DOE programs are expected to be available near the end of 2024.

4. Access Green Mortgage Programs and Preferential Financing

Green Communities certification opens doors to green mortgage programs and preferential financing options. Entities like Freddie Mac and Fannie Mae offer attractive programs:

- Freddie Mac’s Green Advantage provides favorable terms for certified developments.

- Fannie Mae offers a suite of green mortgage loan products, including Green Rewards. Additionally, Green Communities is the only certification that qualifies for both Fannie Mae’s Healthy Housing Rewards and Green Building Certification Preferential Pricing programs.

Stronger Financial Viability

Certifying your affordable homes to the 2020 Enterprise Green Communities Criteria helps you create safe, efficient, healthy and climate-resilient housing – and provides access to financial opportunities that can make or break a development. By meeting green building requirements tied to tax credits, IRA programs, and preferential financing programs, developers and investors can improve the financial viability of their housing developments.

For more information or to get started on your own certification, visit our Green Communities portal or reach out to us at certification@enterprisecommunity.org.