With the one-year anniversary approaching for the Inflation Reduction Act’s (IRA) passage, deadlines are approaching for grant applications, spending plans, and tax credits that can be used to preserve housing, reduce energy costs, and increase climate resilience.

Enterprise hosted a recent webinar that discussed IRA updates, featuring its own experts as well as representatives from HUD and the National Association of State Energy Officials (NASEO). The discussion followed our first webinar in October 2022 that discussed the IRA climate funds available as well as the financing and structuring of tax credits for affordable housing.

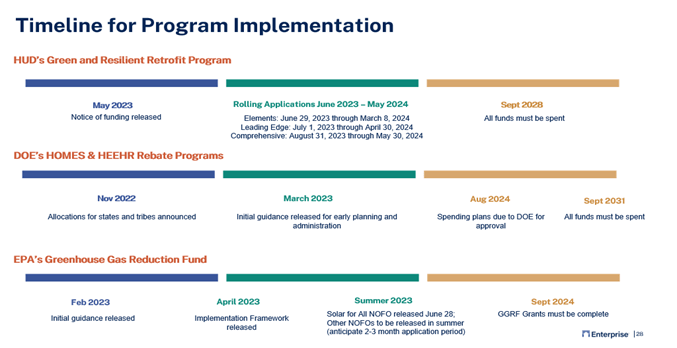

Below are highlights on funding that is currently available, application processes, and timeline for further funding and program guidance.

[For more information, watch a recording of the webinar and view the webinar’s slides.]

HUD Green and Resilient Retrofit Program (GRRP)

The HUD update included information on the GRRP application requirements and timelines for the program’s three cohorts. These cohort applications are eligible for individual properties; organizations may apply for one or several as long as one property is not submitted more than once.

- The Elements Award cohort will provide up to $750,000 per property or $40,000 per unit for construction and transaction costs to add targeted energy efficiency or climate resilient measures into a recapitalization transaction. The program aims to provide gap financing to integrate green or resilient elements into existing property renovation plans. Examples of eligible projects include the installation of Energy Star windows, electric HVAC heat pumps, fire resistant roofs, and clean energy generation systems. HUD expects to make approximately 200 awards with a total of $140 million in funding.

- The Leading Edge Award cohort will provide funding of up to $10 million per property or $60,000 per unit for construction and transaction costs associated with achieving a qualifying green certification such as Enterprise Green Communities criteria and certification. The awards are designed to quickly meet ambitious carbon reduction and resilience goals without requiring extensive collaboration with HUD. Examples of eligible projects include standard property upgrades, electric appliances and systems, solar panels, electrical panel upgrade and fire-resistant shingles and gutter guards. HUD expects to make approximately 100 awards with a total of $400 million in funding.

- The Comprehensive Award cohort will provide funding of up to $20 million per property or $80,000 per unit to initiate major energy efficiency and climate resilience retrofits. The program is aimed at properties with a high need for investment in utility efficiency and climate resilience. Comprehensive Awards are designed for the widest range of properties, making it accessible to owners of eligible projects regardless of construction experience or greening expertise because the scope of work will be developed in partnership with a HUD-provided contractor. Examples of eligible projects include standard upgrades, heat pump HVAC elevated above projected flood levels, rain gardens, multi-pane windows, and community resilience room with backup power. HUD expects to make approximately 300 awards with a total of $1.47 billion in funding.

DOE Energy Rebate Programs

The IRA includes two provisions authorizing $8.8 billion in rebates for home energy efficiency and electrification projects:

- $4.3 billion in grants to State Energy Offices (SEO’s) for the Home Energy Rebate Programs (HOMES) toward rebates based on the energy savings predicted from a home energy upgrade

- $4.275 billion in grants to SEO’s to carry out Home Electrification and Appliance Rebates (HEERA) toward rebates based on purchase or installation of high-efficiency home appliances and equipment

DOE announced State and Tribal allocations for both programs in November, and in March, the agency released initial guidance to states for the planning, administration, and technical assistance allowing access to a limited amount of early administrative funds. DOE plans to release additional guidance this summer detailing programmatic requirements, which is when states will be able to apply for additional funds available in their allocations.

While affordable housing owners/operators will likely be able to apply and access these funds early next year, it is important for them to engage now with their SEO’s and Tribal leadership as the programs are being designed. Engaging in the program design process will better ensure that affordable housing needs are considered, and the ability to access the funds next year will be maximized for affordable multifamily rental owners and residents.

EPA Greenhouse Gas Reduction Fund (GRRF)

On April 19, the EPA released a framework for the implementation of the GGRF, a $27 billion competitive grant program that was enacted in the IRA. The GGRF will leverage federal money to help attract private capital to invest in clean energy projects, reduce pollution, advance energy security, reduce energy costs, improve health outcomes, and create and maintain good-paying jobs in and around the clean energy sector, especially in communities that are low-income or have been historically underserved.

The EPA will divide the competition into three separate but complementary processes that aim to deliver on the program’s goals:

- The National Clean Investment Fund will allocate $14 billion to 2-3 national nonprofits to invest in accelerating a transition towards clean energy.

- The Clean Communities Investment Accelerator will allocate $6 billion to 2-7 “hub” nonprofits that will invest in clean financing capacities for other nonprofits, CDFIs, state housing finance agencies, and other lenders, focused on investing in low-income and under-invested-in communities.

- Solar for All, will invest $7 billion across as many as 60 states, Tribes, localities, and nonprofits to enable low-income communities to be able to add photovoltaic solar power.

On June 28, 2023 the EPA released the first of their three notices of funding opportunity, making available $7 billion under the Solar for All competition. This competition will provide grant funding that may be used by eligible entities to create new or expand existing solar programs that are designed to enable low-income and underserved communities to develop and benefit from residential solar projects. These programs will benefit low-income and underserved communities by providing them with equitable access to residential rooftop and residential community solar power, which can save households a minimum of 20% on electricity bills.

Programs funded by the Solar for All competition will also play a critical role in creating clean-energy jobs and workforce development initiatives that invest in training workers from low-income and underserved communities. Grants of varying amounts will be awarded to 60 eligible applicants, which may include states, territories, Tribal governments, municipalities, and eligible nonprofits. Interested parties are encouraged to join EPA’s Solar for All information webinar on July 12, 2023 1:00pm-3:00pm ET, submit a Notice of Intent to apply this summer (NOI deadlines vary by applicant type), and apply for the grant competition by September 26.

The EPA expects to open the application process for the other two GGRF competitions later this summer. Review our webinar slides or recording for a summary of key details on eligibility characteristics, reporting requirements, and preferred uses of funds according to EPA’s spring framework.

Enterprise is supporting industry efforts to ensure that capital from the GGRF benefits low-income and disadvantaged communities and supports our developer partners. As part of these efforts, we distributed a survey to our developer partners reviewing financing and capacity building needs to help accelerate the transition to an equitable, net zero economy. Our survey prioritized collecting information on solar projects and retrofits on existing building stock, we will be distributing the results in the coming weeks.

Tax Credits

While the IRA includes several provisions for tax credits and rebates relevant to affordable housing properties, our session this month focused on the investment and production tax credits for renewable generation, On June 1, the IRS released proposed rulemaking on the Low-Income Communities Bonus Credit Program. This adder enables taxpayers to receive additional tax credits (up to a 20 percent competitive boost on top of the existing 30 percent investment tax credit) for eligible solar and wind facilities serving low-income communities. And on June 14, IRS issued notice of rulemaking for transferability and direct pay. In our session, we reviewed how the ITC and its adders can contribute to the financial stack of solar development on affordable housing properties as well as various use cases for the tax credit transferability and direct pay options. Review our webinar recording and/or slides for additional examples of how these may be paired with state credits, battery storage systems, and incentives for EV Charging Stations (Section 30C) and energy efficiency measures (Section 45L and Section 179D).

Enterprise recently submitted comments to the IRS on the proposed Low-Income Communities Bonus Credit Program rule. Key recommendations featured in the comment letter include allowing for a reduction in the equitable distribution requirement, which entails distributing financial benefits and cost savings attained through the energy facility equally among low-income residential units or proportionally based on electricity usage. This reduction would be calculated based on the number of residents who choose not to subscribe to solar or wind energy facilities. Enterprise’s comments also propose revisions to the program’s requirements, including accepting applications with solar and wind facilities placed in service prior to the passage of the IRA and those that include affordable housing properties financed by the Low-Income Housing Tax Credit and owned by a for-profit Limited Liability Company or Limited Partnership.