Home prices rose at an accelerated pace in 2021, and rent has gone up 17.6 percent across the country. The housing shortage continues to be acute, and inflation is putting the squeeze on low-income families and communities.

In this Enterprise Q&A, Anne Griffith, co-leader of our upward mobility initiative and senior director, programs, explains how rising prices force difficult economic choices on American families – and how Enterprise is incorporating upward mobility into our all of our work.

Q: Anne, I think everyone knows prices of food, gas and other essentials are on the rise. How does inflation impact families with lower incomes, especially when it comes to housing?

Anne Griffith: I think low-income families – and I would say low-income families of color in particular – are impacted by inflation because there’s less margin, less cushion when costs rise. In the affordable housing realm, we consider housing to be affordable when it costs 30% of someone’s income or less. But even when we use that calculation, we know that low-income families often still have to make really hard decisions, uncomfortable tradeoffs, about how they’re going to spend their money.

That can show up in many places. It could be that you’re unable to repair your car, and that may impact your ability to get to your job or to find a different job that pays more. It may lead to a decision about not pursuing a health-related matter. It may be a decision about how much food you’re able to put on the table or even the quality of that food.

Q: How do rising costs impact people in, say, urban areas differently than they do for people in rural areas?

Anne Griffith: In an urban environment, gas prices may be higher, but you may have more transportation options that would allow you to get around town in a more cost-effective manner than someone in a rural community. And, of course, costs are relative. Here in the Bay Area, we’re experiencing a much more significant price increase in gas and other expenses, but we have a higher minimum wage and, to some extent, greater access to other resources than other communities, which might soften the blow.

In our work advancing economic mobility, we approach each community by looking at their unique conditions, rather than assuming that the conditions in one area are the same as those in other regions. We need to understand on-the-ground conditions to identify how housing opportunities can be used to support families in that neighborhood. There’s no one size fits all.

Q: Politico had a headline the other week: “The main driver of inflation isn’t what you think.” And the answer was housing costs. Why do you think housing is sometimes overlooked as a driver of inflation?

Anne Griffith: I think whether someone considers housing to be an overlooked driver of inflation is based on their own position in society. There are a lot of low-income folks, and a lot of low-income people of color in particular, who would say that they’ve been thinking about the cost of housing as a driver of inflation for a long time. They’ve been doubling up in housing situations and have been forced into less ideal living conditions for quite some time.

We’re seeing a rise in homelessness not just in urban areas, but also suburban and rural areas. Of course, the idea that housing costs are becoming unsustainable is obvious to anyone experiencing homelessness. So that suggests how we look at housing costs has a lot to do with how comfortably housed we are.

Q: Interest rates are slowly creeping upward. How does that affect low-income renters?

Anne Griffith: The increase in the cost of homeownership has a number of impacts that trickle down to renters. Unfortunately, economic benefits don’t trickle down, but economic challenges do. When the price of homeownership increases, families who might’ve bought when prices were lower remain in their rentals or move to other rental homes, which leads to less availability in the market. We already exist in a constrained rental market, and it only becomes more constrained as people aren’t moving into other forms of housing.

Second – and we saw this during the Great Recession – we see that owners of properties now find themselves with mortgages that are more costly because of rate adjustments, and those costs can be passed along to tenants, especially in communities without protections against rent increases. Rising interest rates can also more broadly destabilize the market as owners see their risk of foreclosure rising again. That could lead to evictions or bank ownership, which increases instability.

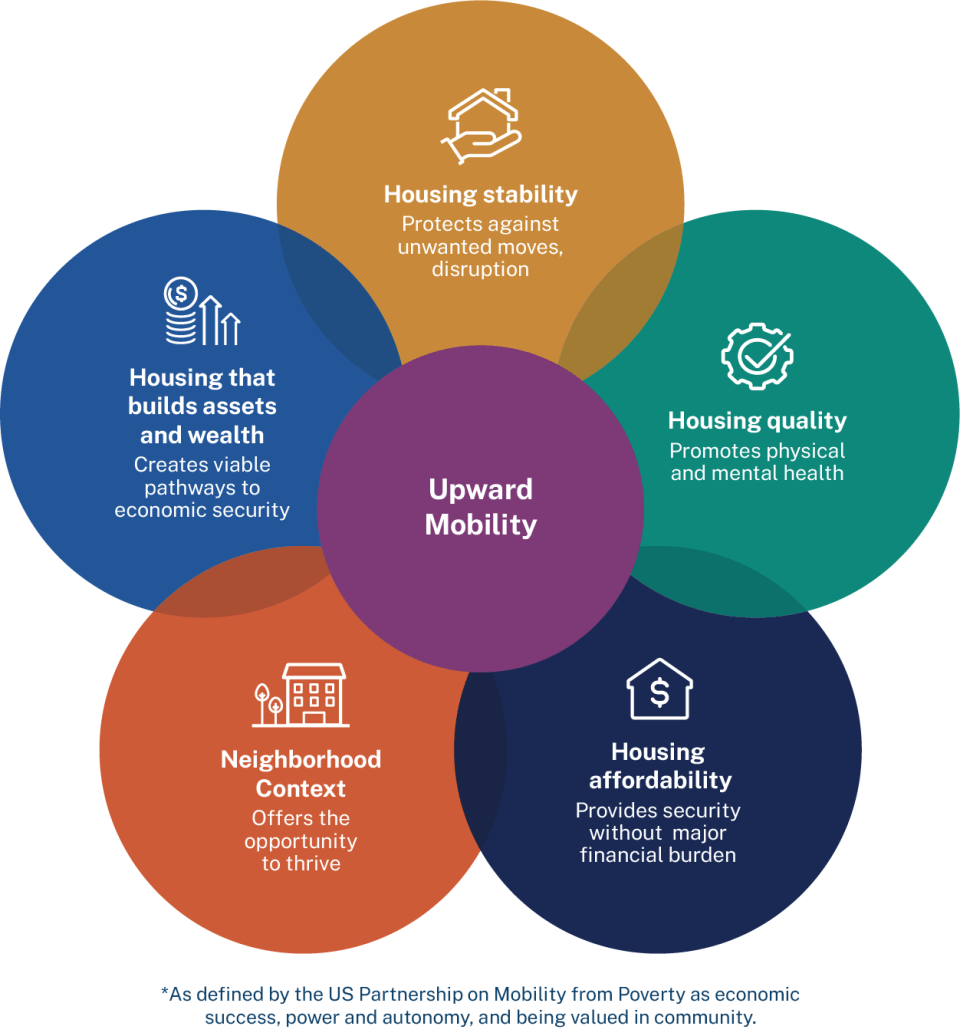

When we think about how housing impacts economic mobility for folks, we focus on what we call the “housing bundle”: affordability, quality, stability, the neighborhood context and housing that helps build wealth or assets. Research has shown that all five of these attributes must be present to affect upward mobility. So if of any of those attributes are affected by rising interest rates, it can impact an individual’s long-term economic trajectory.

Q: We often think in the context of how this affects renters – but it also affects landlords, right?

Anne Griffith: Right. As owners of multifamily properties see mortgage costs rise, they’re also seeing other costs go up as a result of inflation – things like maintenance and repair costs are extremely expensive right now. All that gets passed along to the renter, especially in places where there are few tenant protections.

Q: How do we incorporate upward mobility into our work at Enterprise to address some of these issues?

Anne Griffith: It’s truly something that impacts all of our work because housing affordability, stability and quality are core to Enterprise. In the policy arena, we pay attention to and advocate for resources that will assist renters who need relief in these moments. And we’re continuing to advocate for resources that will increase the supply of regulated affordable housing in more places, like housing tax credits and vouchers. We’re also providing technical assistance and support through many of our programs and regional market offices to assist developers on the ground in providing more affordable homes for more families. To promote economic mobility, we also apply a race-conscious lens and consider the other elements of the housing bundle, namely the neighborhood context and whether that housing helps build wealth or assets.

One thing we appreciate when we apply an economic mobility lens to our work is that housing is not an outcome, but rather an important platform for a family’s trajectory. We don’t just focus on housing but also on the role it plays in a person’s life. We support cross-sector partnerships in education and health and we’re now exploring how housing intersects with the criminal legal system.

This is a moment to peel back and examine the impact inflation and all its related costs are having on families and to think about the ways we can do things differently. Crises hit quickly, but solutions come more slowly. Coming out of Covid into uncertain economic conditions gives us the opportunity to explore radically new ways to approach housing and economic mobility in our communities. It’s opening up that conversation.