Enterprise’s Tribal Nations & Rural Communities has supported safe, decent and culturally relevant housing on tribal lands and rural communities since 1997. We’ve helped create or preserve 40,900 affordable homes by leveraging over $1.9 billion in capital across the region.

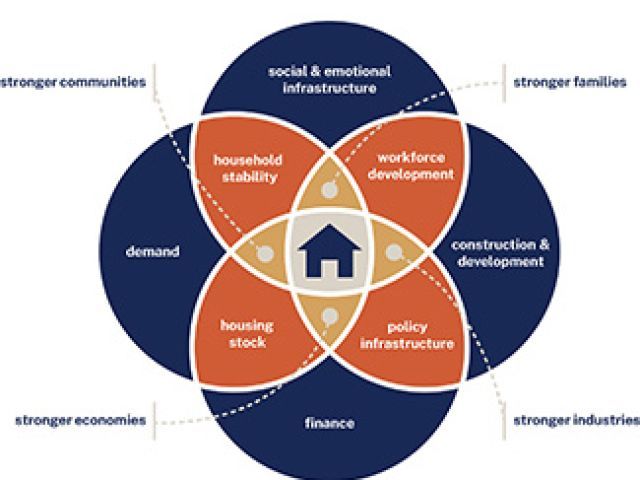

We provide funding and training along with technical assistance to organizations to help create healthy, safe, green affordable homes and to increase opportunities for economic advancement for individuals and families in both rural and Native communities.

- Native Communities Learning Cohort: Expand access to homeownership opportunities for Native Americans, Alaskan Natives and native/Native Hawaiians by building the capacity of housing providers (including tribes, Tribal Housing Authorities, Tribally Designated Housing Entities and Native Community Development Financial Institutions) to enhance and implement homeownership programs

- Rural Preservation Academy and Technical Assistance Cohort: Preserving affordable rural rental homes through technical assistance and the delivery of trainings and peer-to-peer learning sessions designed to help rural housing providers acquire and/or preserve rent restricted housing in their communities.